How will this Impact the Critical Minerals Market?

Published 31-AUG-2024 12:33 P.M.

|

13 minute read

- Commentary: World wars and past rotations of global superpowers. Passive countries increase defence spending in times of global uncertainty. Europe and US localising supply chains.

- Quick Takes: GAL, KNI, SGQ, HAR, AL3, PFE, PUR

- This week in our Portfolios: TG1, SS1, EMN, ONE

This week was a little bit different for one of our team members.

With a visit to the Imperial War Museum in London.

The museum focuses on World War I and World War II.

Including the geopolitical sequence of events that led up to each war.

None of our team have lived through such times.

Nor did our parents.

Surely a “world war” won’t happen in our lifetimes.

(we certainly hope not)

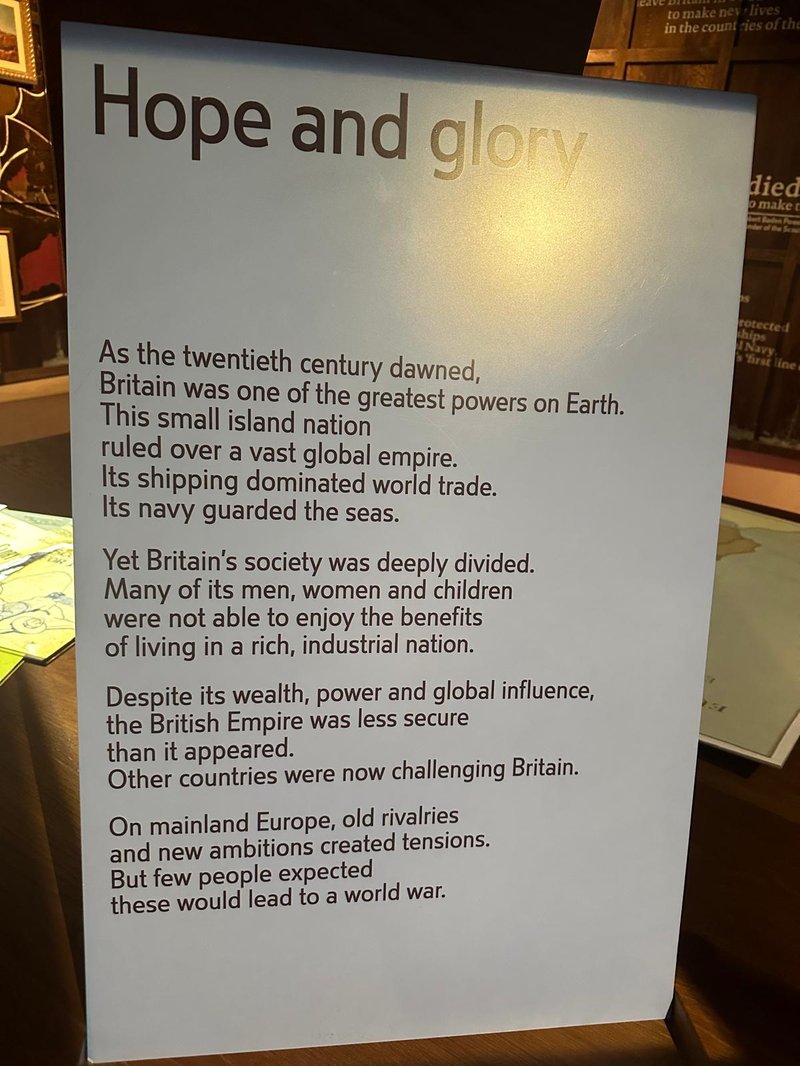

What stood out during our museum visit was what happened in the lead up to the world wars.

The incumbent global superpower of the time Britain (and its colonies) were being increasingly challenged:

(Source - Imperial War Museum)

During our lifetimes, we have only known the USA as the dominant world power who has policed the seas and imposed their will (and military) into various countries for various reasons.

And recently we have seen China start to emerge as a challenger.

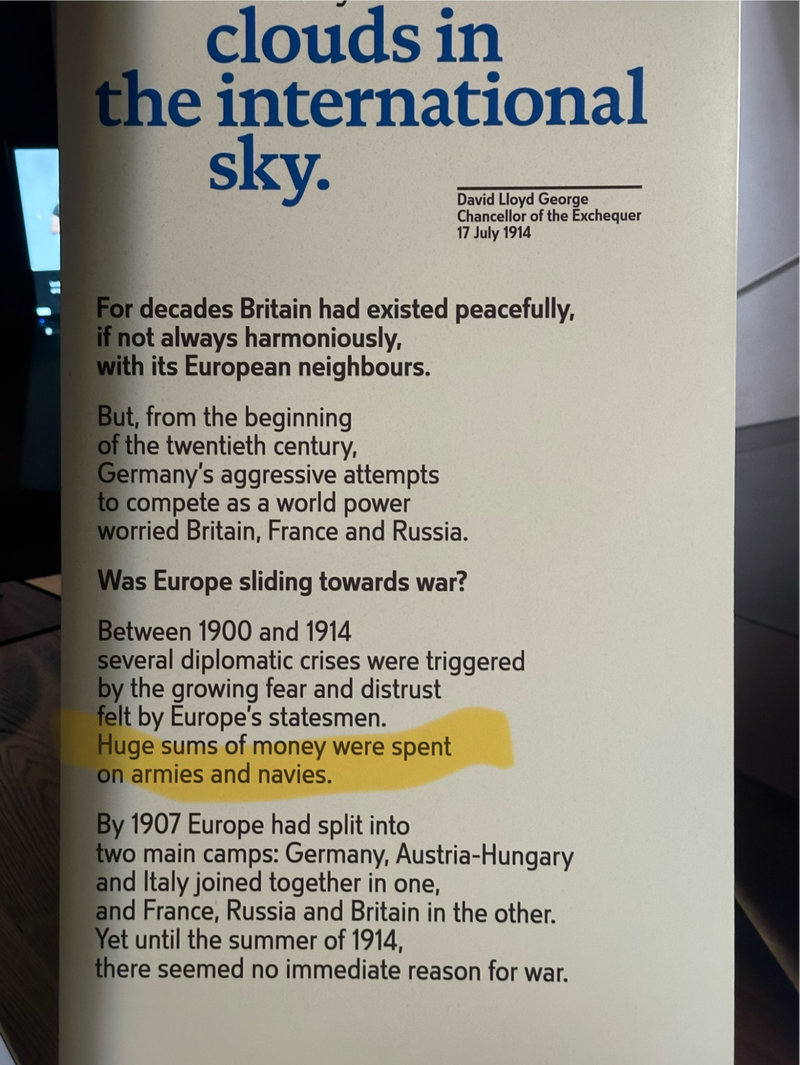

Sounds a bit like this summary from the early 1900’s, just replace “Britain” with “USA” and “Germany” with “China” to get the jist:

(Source - Imperial War Museum)

Now we certainly aren’t saying a new word war is brewing, but we do acknowledge that the US led world order is being challenged by China.

And what we learned is that when a “world order” has been challenged in the past by one country, other ambitious and opportunistic countries try to advance their positions in their local regions that may have previously been “policied” by the current global power.

This broadly leads to increases in spending on defence by many countries as a deterrent, in anticipation of uncertain times...

More defence spending makes emboldened neighbours think twice about “messing with you” while the “world police” are distracted.

We saw the examples at the war museum for global power Britain leading up to WW1 (1914–1918) and WW2 (1939–1945).

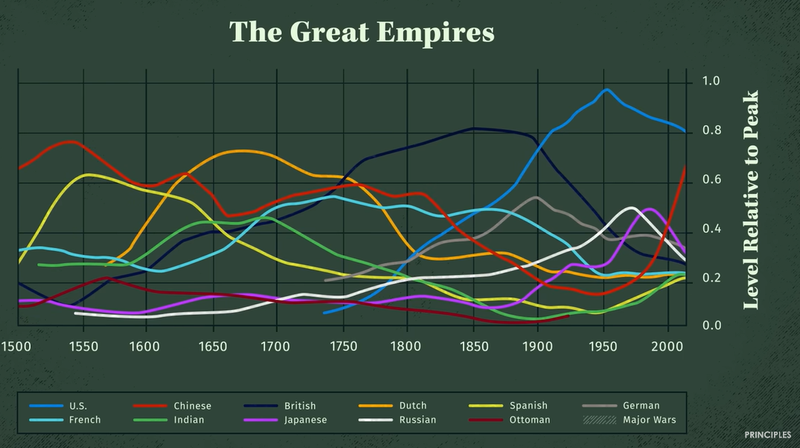

Before the British Empire the Dutch were the world power.

And before the Dutch, it was the Spanish.

For a more in depth analysis than our visit to the museum, we recommend the following:

1. “Principles for Dealing with the Changing World Order”. Bridgewater Associates hedge fund manager Ray Dalio wrote a book analysing the last 500 years of rises and falls of world powers from an economic and investing perspective.

You can watch a 5 minute summary video of the book here or a more in depth 45 minute version here.

2. “World Order” - US statesman Henry Kissinger summarises the balance of world power over the centuries since the formation of Europe to our own times. Check out the book here.

So a changing of the world order has all happened in the past, multiple times - just not during our lifetimes.

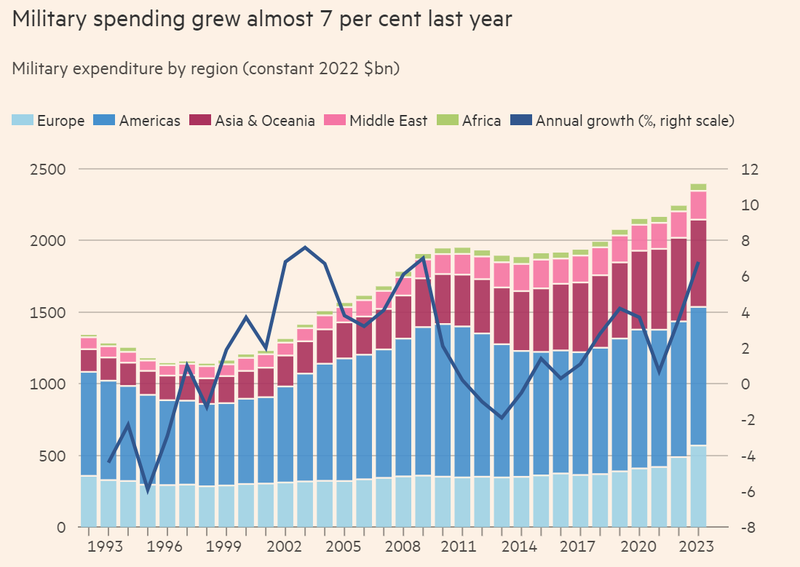

And with China challenging the US led world order and the world a bit on edge at the moment, we have started to see big increases in spending on defence, even by passive countries.

Last night Poland announced a “record” and “unprecedented” defence budget.

(Source)

12 hours ago Japan requested its largest ever defence budget.

(Source)

Back in April, FT reported that global defence and military spending is on the rise:

(Source)

(Source)

And a few days ago:

(Source)

Looking through our Portfolio, one company stands out as it is directly selling to aerospace and defence companies.

We Invested in AML3D (ASX:AL3) because we think its 3D printing of complex metal parts for defence supply chains will be in demand from increased contracting activity in the defence industry.

AL3 is important for two key reasons:

- Tech perspective - Modern manufacturing technology (3D metal printing) is faster and cheaper than the existing processes used to produce parts in highly specialised defence supply chains.

- Security of supply perspective - of supply perspective because the 3D printers can push out important highly specialised parts on demand and wherever they are required.

AL3 had already put out some material news since we Invested...

- $1.1M sale to US Navy supplier - US traction growing.

- A new agreement with Boeing Defense and Space

- More than 500% growth in cash receipts over last financial year.

AL3 is close to opening up a facility in Ohio to accelerate its push into the US market.

We think US expansion could be material for AL3 given that the US is putting serious cash behind important defence supply chains (read our AL3 initiation note here).

Speaking of taking action on critical US defence supply chains...

Antimony is a critical mineral used in the defence industry.

...and the world’s largest antimony supplier China has just announced antimony export restrictions.

(what a time to ban a key material for defence products as the world is ramping up defence spend)

Antinomy prices have doubled in the past 6 months, sending the markets a clear signal that capital needs to flow in its direction...

It is still very early days but so far two of our Portfolio companies are doing work to see if their projects have antimony potential:

- Sun Silver (ASX:SS1) - SS1 has ASX’s biggest primary silver deposit as of this week, but also had some decent antimony hits in drill cores a few weeks ago. This could be big if antimony iss across the whole deposit. SS1’s project is based in the USA (read more here)

- TechGen Metals (ASX:TG1) - It is very early days but TG1 announced rock chips with grades up to 7% antimony on one of its WA projects this week. Its super high grade... but then again, they are just rock chips for now... (read more here)

Last weekend we wrote about antimony and China’s export restrictions on the commodity fairly extensively.

We said the new antimony restrictions may be the reminder the world needs to refocus on securing critical metals supply for other important industries too.

Especially in these growing uncertain times.

Europe positioning itself to secure critical minerals...

This week we looked closer at Europe as it moves to jockey for position in the critical minerals race.

The reason that Europe is in the spotlight is that the first deadline or “call” for mining companies to apply for “Strategic Project Status” passed last week (Source).

When you normally think of global mining regions, Europe is not at the top of the list.

Africa, Australia, Canada, South America... yes...

But not Europe.

As a continent Europe has a greater focus on smelting and mineral processing rather than ‘picks and shovels’ mining.

This has meant that Europe is short in defined mineral reserves and has had to rely on trading partners for both its energy supply and critical minerals.

And in a less orderly global landscape, supply risk from other countries increases.

This all came to a head when the Russia-Ukraine war broke out in 2022, and Germany and its neighbours suffered from reliance on Russian natural gas.

To secure supply chains for critical minerals within Europe, the European Critical Minerals Act was enacted.

The minerals that Europe is most interested in are those that are important to the global energy transition.

Things like lithium, nickel, cobalt and manganese.

The act sets out a broad set of goals for the EU as a whole, those goals are as follows:

- At least 10% of the EU's annual consumption for extraction,

- At least 40% of the EU's annual consumption for processing,

- At least 15% of the EU's annual consumption is for recycling,

- Not more than 65% of the Union's annual consumption of each strategic raw material at any relevant stage of processing from a single third country.

To fast track achieving these goals, the EU has set up “Strategic Project Status” where certain advanced projects that fit the criteria are granted special privileges.

“Strategic projects” have two key advantages:

- Fast Track Permitting - Permitting has always been an issue in the EU. With the EU setting a timeframe of 27 months for extraction permits and 15 months for processing or recycling permits, it provides more certainty for investors that are looking to develop these assets. Of course at the same time, each country within the EU will have its own processes for permitting, but at least we know the EU is trying to incentivise these projects to become a reality sooner.

- Funding support - Strategic projects can get access to government grants and financing from other institutions inside the EU. Institutions like the European Investment Bank (EIB), which is expected to commit to over €150 billion in investment by 2027. The EIB has also committed €1 trillion in climate investment this decade - to give a sense of the scale of the investment unfolding. (Source)

It is worth noting that this is an EU wide policy framework.

How the member countries end up implementing will change from country to country.

That said, having “Strategic Project Status” could be a game changer for Europe and some of the ASX small cap stocks looking to develop mining projects in the region.

Europe has been a notoriously difficult place in recent years to develop mines.

However this plan by the EIB indicates that the corner has turned, and Europe looks to be back in the critical minerals race dominated by the US and China.

Of the stocks in our Portfolio, three have submitted applications for Strategic Project Status with the EU (or indicated an intention to apply):

- Vulcan Energy Resources (ASX:VUL) - Development-stage lithium brine project in Germany, VUL already has a deal in place with the European Investment Bank for €500 million in funding (subject to due diligence). Strategic Project Status could be the catalyst to finalise the deal.

- Euro Manganese (ASX:EMN) - Development-stage high-purity manganese project in the Czech Republic. Read our note on EMN’s application earlier this week here: Two offtake term sheets in two weeks.

- Kuniko (ASX:KNI) - Exploration-stage company based in Norway submitted its application this week. See our Quick Take on that KNI news here: KNI submits EU Critical Raw Materials application

The results from the first round of applications are due by the end of December of this year.

It adds a potential catalyst to look forward to for all three of our Investments.

Speaking of catalysts, there are a number of key events across our Portfolio that we are looking forward to over the next month.

What to look forward to in the next month from our Portfolio

Catalysts are the bread and butter for small cap stocks.

It is a piece of news that could move a company's share price in a significant way (up OR down), depending on the outcome.

So, let’s take a look at a few of our Portfolio companies that have some “known unknowns” that could drop in the next 30 days or so:

- Elixir Energy (EXR) - Final flow test results from its Queensland gas project. Strong results here could be a company-maker for EXR.

- Sun Silver (SS1) - Drill results from 7,500m drill program for silver, gold and antimony. We are looking forward to seeing if SS1 can continue to hit high-grade results from step-out holes over its project.

- Minbos Resource (MNB) - Final project financing for phosphate mine in Angola. This could drop any day now, and is the final hurdle before MNB can start construction on its mine.

- Mithril Resource (MTH) - Further drilling results from its giant silver and gold project in Mexico.

- Mandrake Resources (MAN) - Maiden JORC resource over its lithium brine project in the USA.

- Titan Minerals (TTM) - TTM signed a $120M deal with a subsidiary of Hancock Prospecting to earn an 80% interest in its copper project in Ecuador. The first tranche of US$2M is payable to TTM on execution of a formal binding agreement.

- St George Mining (SGQ) - Finalise Brazil niobium project acquisition.

What we wrote about this week

TechGen Metals (ASX:TG1)

Copper, gold...

... and now antimony?

TG1 put out news of rock chips with grades as high as 7.05% antimony.

Commodities can go in and out of fashion quickly, and antimony is definitely the flavour of the month for the ASX small cap market... as you can tell from reading the above.

Let’s see if TG1 can seize the moment.

Read: TG1 finds 7% antimony in rock chip - nice timing

Sun Silver (ASX:SS1)

SS1 now has the biggest primary silver resource on the ASX.

And the silver price is back near decade highs above US $30 per ounce...

... after touching above $32 a couple of months ago.

This week SS1 announced a remodelled 423 million ounce silver equivalent JORC resource at its project in Nevada, USA.

Read: SS1 is now the biggest silver resource on the ASX. Silver price moving too?

Euro Manganese (ASX:EMN)

Two offtake term sheets in two weeks.

And possibly “Strategic Project Status” at the end of the year...

Momentum is now building for our EU based critical mineral Investment Euro Manganese (ASX:EMN).

Read: Two offtake term sheets in two weeks.

Oneview Healthcare (ASX:ONE)

ONE is looking remarkably resilient on the charts, increasing 70% since the start of the year.

This is actually quite impressive in a down market for many small caps.

But how and why? And will it keep going up?

Read: A $29BN reseller, a mobile product and a billionaire major holder - in ONE company

Quick Takes

GAL drilling to the north of its PGE-nickel discovery

KNI submits EU Critical Raw Materials application

Former Brazilian Minister of Mines joins SGQ as advisor to the Board

HAR publishes resource update to uranium project in Senegal

PFE’s lithium well re-entry “imminent”

PUR hits high grade lithium in 2nd drillhole

Macro News - What we are reading & listening to 📰

Energy:

Top Countries by Fossil Fuel Consumption in 2023 (VisualCapitalist)

- China and the U.S. accounted for 47% of global fossil fuel consumption in 2023, with China leading in coal use.

- Fossil fuels comprised 81.5% of the global energy mix in 2023, despite renewable energy growth.

Japan’s Global Gas Empire Fuels Worries About Climate Change (Bloomberg)

- Japan controls a quarter of global liquefied natural gas (LNG) shipments, positioning itself as a key player in the $250 billion LNG market.

- With government support, Japan offers a full package for countries switching from coal to gas, including technology, financing, and fuel.

Gold:

The Fuse for Juniors Has Been Lit! Cash Flow for Producers Jumps in Q2 (The Gold Advisor)

- Rising gold prices have boosted gold producer profits, setting the stage for a capital flow into junior mining stocks.

PLS ASX: UBS, Morgan Stanley slash lithium forecasts, warn mines need to close (AFR)

- Lithium prices have plummeted, leading to mine closures and delayed projects as the sector faces mounting pressure.

- Despite some production cuts, UBS warns more curtailments are needed as lithium prices continue to decline.

Are you a s708 sophisticated investor?

If you qualify as a sophisticated investor and would like to see “s708 only” sophisticated investor opportunities: Subscribe to Next Cap Raise.

You will need to send us a valid certificate from a qualified accountant confirming you qualify as a sophisticated investor.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.